Budget Status Summary

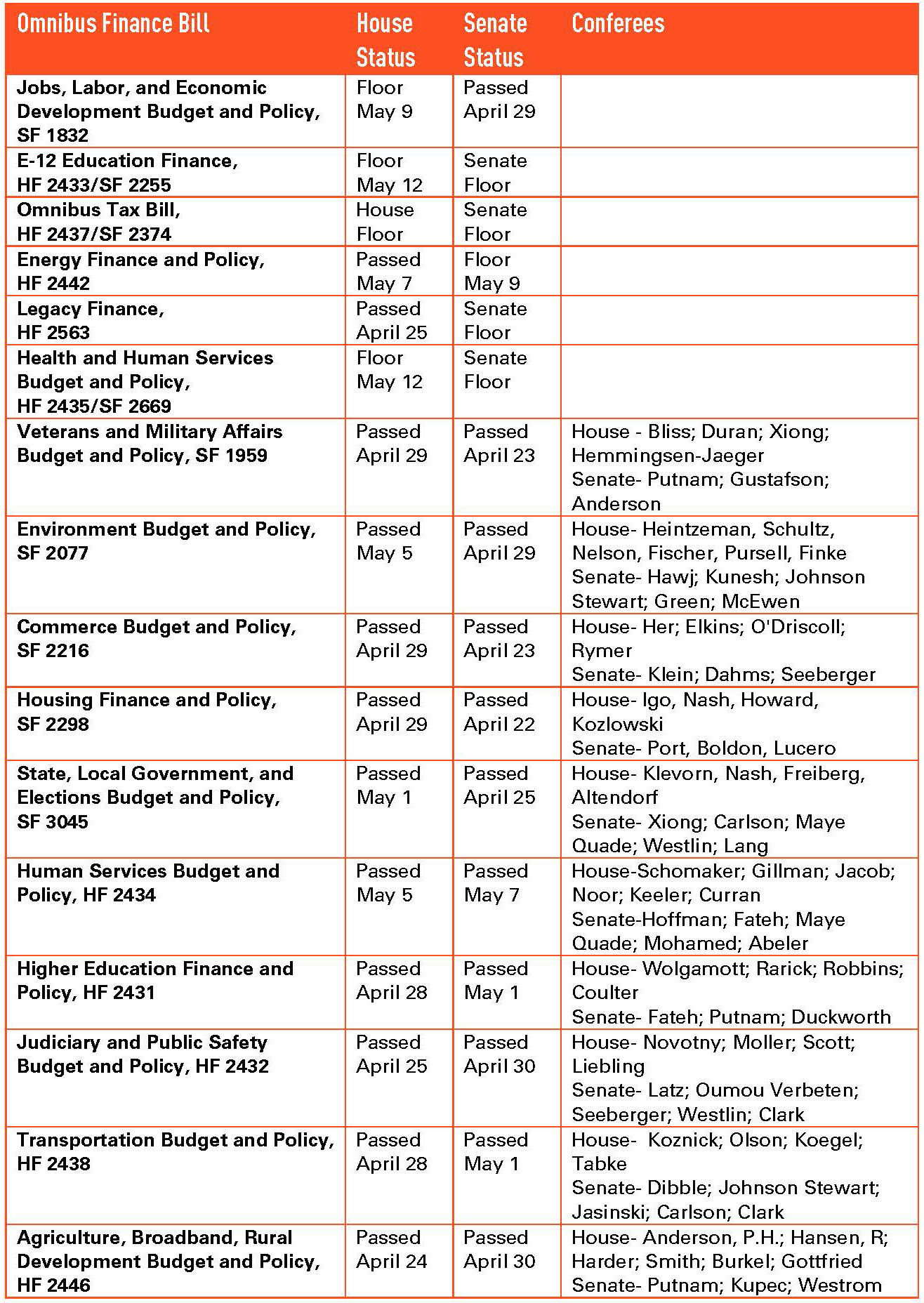

With the end of the 2025 legislative session fast approaching, legislators are working to approve the omnibus finance bills necessary to implement a FY 2026-2027 Biennial Budget. Legislative leaders and the Governor continue to work behind closed doors on global targets with rumors swirling that a deal is within grasp. However, as you can see from the chart below, the House and the Senate have yet to pass a number of major finance bills as of this writing (May 9).

Non-Controversial House Tax Bill

With the House tied at 67-67 between Republicans and DFLers, it should come as no surprise that the House Tax Committee this week passed a non-controversial Omnibus Tax Bill. The bill is a collection of no- or low-cost provisions and policy tweaks across tax types advocated for by various stakeholders and interest groups. Working with only a $40 million target for FY 2026-2027, the Tax Committee’s options were limited.

Senate Tax Bill Includes Revenue Raisers

While the House pieced together a bill that could pass a tied chamber, the Senate used a higher budget target to assemble a bill that raised new revenue, combined with cuts to certain tax spending. The Senate bill raises $317 million in general fund revenue and includes $48 million in reductions to aids, credits, and other expenditures to equal a $365 million budget target. The main sources of revenue include a new social media excise tax, an increase in the net investment income tax rate, and a lowering of the net operating loss deduction limit. The Senate cuts Local Government Aid, County Aid, the Film Credit, and the Sustainable Forest Incentive Payment Program.

Changes to Employer Mandates in Play

Changes to employer mandates are part of the negotiations for global budget targets. Modifying employer mandates, which passed during the DFL trifecta’s majority in 2023 and 2024, has been a priority for the business community and Republicans this legislative session. While Republican leaders are attempting to negotiate a more workable definition of “family” under the new paid family leave law, a bipartisan group of Senators this week passed off the Senate Floor key changes to the new earned sick and safe time (ESST) law. The Senate Bill, which still must pass the House, exempts farms with five or fewer employees from the mandate along with all businesses with less than four employees.

Senate Releases Bonding Framework

The Senate Capitol Investment Committee on Thursday held a hearing on a $1.35 billion Bonding Bill. The proposal, released as a spreadsheet, primarily included initiatives from the Walz Administration along with the University of Minnesota and the MNSCU systems. The proposal did include a $459 million placeholder for local projects but it did not name the projects.