Minnesota is launching a statewide Paid Family & Medical Leave (PFL) program on January 1, 2026 – a sweeping new benefit program that will offer job-protected leave and partial wage-replacement benefits to nearly all Minnesota workers. Though benefits don’t begin until 2026, employers must act now to prepare, with compliance deadlines starting as early as December 1, 2025.

You may already be familiar with the basics — and might even have a solid grasp of what’s coming. But have you done the legwork to prepare? Let’s talk implementation strategies to avoid compliance headaches and unnecessary costs.

Program Snapshot

For a more detailed overview of the program, please refer to our previous article, Minnesota’s New Paid Family and Medical Leave Law.

Keep in Mind

Eligibility: If you are under the State plan (which is the default), the Minnesota Department of Employment and Economic Development (DEED) will review employee applications and determine eligibility. However, if you’ve opted into a private plan, then your employer or private insurance provider will handle the eligibility review instead.

Benefit Amount: This is a partial wage replacement benefit that will provide payment for up to 90% of the average weekly wage, up to a maximum weekly benefit of $1,423 (2026).

How Much Leave Is Available? Employees may be eligible to take up to 20 weeks of paid leave per benefit year — combining 12 weeks for medical leave and 12 weeks for family leave, but not to exceed 20 weeks total.

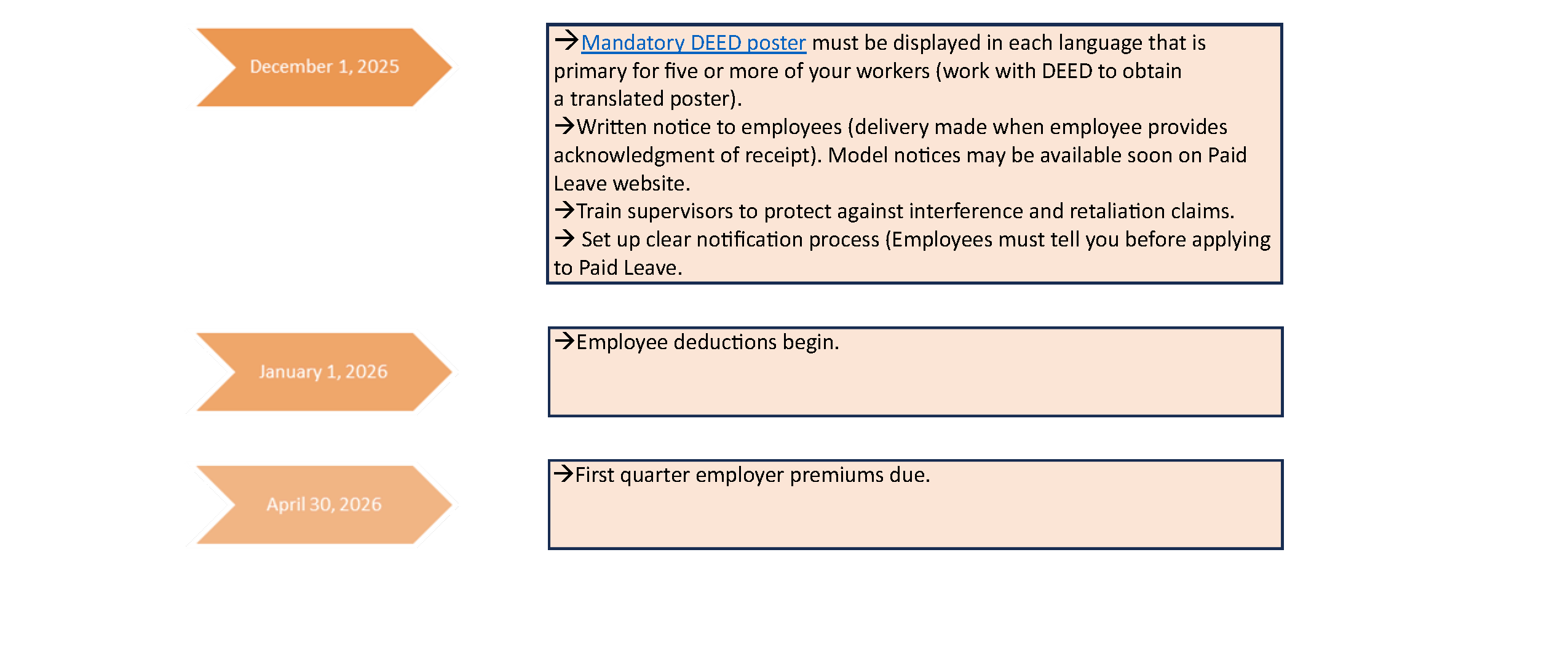

Premiums: The premium rate for 2026 is 0.88% of employee wages, with up to 50% of that cost eligible to be allocated to employees. Employers must include the employee’s share of the premium in the required notice to current employees — which is due no later than December 1, 2025.

So far, the trend among employers has been to pass along the full 50% to the employees, although some may choose to cover the entire premium themselves.

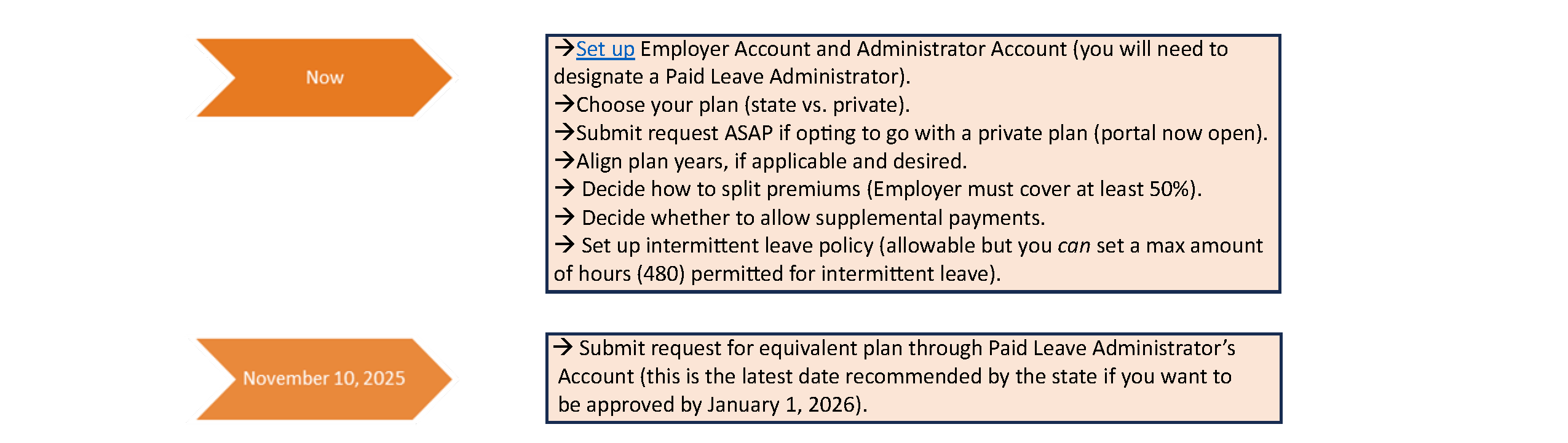

Public vs. Private Plans: If you choose to opt out of the State plan by offering a private plan with benefits that are at least as generous as the State plan — submit your request as soon as it is ready. Employers can request an Equivalent Plan Substitution through their Paid Leave Administrator account. Applications are reviewed on a rolling basis and the portal is now open. The State is suggesting that if you want a private plan to be approved and in place by January 1, 2026, your application should be submitted no later than November 10, 2025.

Taxation Considerations

Premiums: Employers may write off the amount they are required to pay into the Minnesota Paid Leave program as an excise tax, and if they choose to cover more than that minimum, the extra amount can also be written off as a regular business expense. For employees, any portion of the premium that they pay themselves is treated just like ordinary wages: it shows up on their Form W-2 and does not lower their taxable income. When an employer picks up more than the required share, that extra payment is considered additional income to the employee and is therefore subject to income and payroll taxes. If the employees itemize deductions on their federal income tax return, they may deduct this additional contribution by the employer as state income tax, subject to applicable limitations.

Taxation of Benefits: Minnesota Paid Leave benefits are generally taxable, but benefits received under family leave will be treated differently than those under medical leave. Family leave benefits are not considered wages and are not subject to employment taxes, but are reported as income. Medical leave benefits are split: half will be treated as wages (subject to income tax withholdings, Social Security, and Medicare taxes), and the other half will not be taxable as wages. Applicants for these benefits will have the option to withhold state and federal taxes from their weekly benefit.

Understanding the tax treatment of these benefits is critical for employers as it affects payroll reporting, W-2 preparation, and business tax deductions. Proper handling will ensure compliance with the tax laws and help prevent reporting errors. For more information on taxes and paid leave, please visit DEED’s published guidance.

Coordination with Existing Leave Laws:

Adding a new leave entitlement means your policies must work together — or you risk extended absences and higher costs.

If your policies are not updated, employees could stack leave benefits, extending their time off well beyond what is contemplated by this State program. To avoid these costly consequences: (i) run leave concurrently where allowable (e.g., FMLA, MN Pregnancy and Parenting Leave); (ii) align your plan years to avoid confusion and resetting of eligibility at inopportune times (note that adjusting FMLA plan year requires 60 day notice); and (iii) clarify which benefits (e.g., PTO, ESST, STD) may be used to supplement PFL income.

The bottom line is employers have options to manage the impact of this new law – but action is needed. Coordinating these leave policies will be key to cost control and workforce planning.

What Should I Be Doing Over the Next 8 Months?

Minnesota’s PFL law is a game-changer — not just for employees, but for how employers manage leave, payroll, and compliance. The timeline may feel distant, but waiting too long could mean operation disruptions and higher costs that could otherwise be avoided.

Start planning today to ensure a smooth transition and avoid being caught unprepared.

For questions, please reach out to any member of our Employment team.