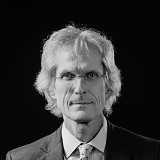

Paul W. Markwardt

Law, for me, is trying to address differences through reason.

Contact: P /612.604.6643E /[email protected]

Administrative Contact: Colleen Shumaker P /612.604.6648E /[email protected]

Education

New York University School of Law, LL.M., Taxation, 1993

Creighton University School of Law, J.D., summa cum laude, 1986

Creighton University, B.S., Business Administration, summa cum laude, 1983

Bar Admissions

Minnesota

New York

My Approach

Tax issues are a puzzle – you know, logically, there are pieces that can be put together into a clear picture, but when you start out, you only see a scramble on the table. I partner with clients to look at those pieces in a pattern, and begin putting them together. It is important to recognize that other parties in a transaction see the puzzle differently, too – each one has issues that are important to them. Successful deals are made by addressing the key components for each party, and being flexible on less essential aspects.

Outside of work, I tend to my flower and vegetable gardens, as well as a small orchard with apples, pears, plums, and peaches, which the deer do a very good job of helping me maintain

A Groundbreaking Moment in My Career

Early in my career, I had an opportunity to go to New York City to practice law in a large firm. While there, I was working simply in a tax department, and had exposure to a number of different areas of tax. The size of the firm afforded me the luxury of looking at issues in a very in-depth manner, and learned a great deal while I was there. I stayed for six years, before deciding I was ready for a new experience, and came back to the Twin Cities, but I don’t think I could do what I do without the foundation I gained from digging into the issues and internalizing them.

Practice Areas

Practicing Tax Planning & Transactions

My Experience

I represent clients with a wide range of sophisticated tax concerns, including tax-planning issues in the areas of mergers and acquisitions, real estate taxation, securities offerings, and general corporate and partnership taxation. I regularly review finance documents, equity partnership agreements, and other deal components to assess the tax-related aspects and ensure viability for my clients.

Practicing Tax Credit Financing & Syndication

My Experience

I represent real estate developers, for-profit or non-profit, in addressing tax related issues in real estate development, especially where they involve federal and state tax credits. I bring to them an experience associated with having seen a large number of different affordable housing transactions, both in Minnesota and nationwide. Because I have seen different types of approaches that various lenders, housing credit agencies or government sponsors of projects have taken, I help clients understand their interests and motivations, and accommodate them in a way that can make my clients’ deals stronger.

Also experienced in

Real Estate Development & Transactions

Honors & Awards

Best Lawyers in America®

Real Estate Law, 2022-2026

Tax Law, 2024-2026

MSBA North Star Lawyer

Pro Bono Service, 2015-2016

AV Preeminent

LexisNexis Martindale-Hubbell, Peer review ratings

Super Lawyers®

Minnesota Law & Politics, 2003-2006

Top Lawyers in Minnesota

Minnesota Monthly, 2024

Associations & Memberships

Minnesota State Bar Association

American Bar Association

Minnesota State Horticultural Society

Board Member